ASIC and ATO Reports

Our reports centre gives you quick and easy access to the necessary data required by ASIC and the ATO.

Try for free

ASIC notification and lodgement

Users with Admin and Read-Only access are sent an email at the end of each week notifying them of information, if any, that should be reported to ASIC.

You can lodge the information with ASIC yourself or appoint Registry Direct as your agent to make the lodgements on your behalf.

TFN reporting

Issuers can generate tax file number reports (TFN) each quarter which are designed to be lodged directly into the ATO Business Portal.

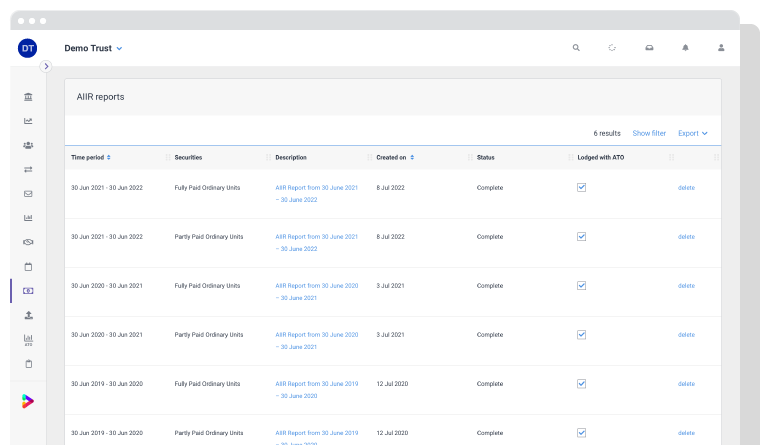

AIIR reporting

Generate Annual Investment Income Report (AIIR) reports after each financial year. The AIIR reports comply with the latest ATO specification and can be lodged directly into the ATO Business Portal.