Tax statements

Registry Direct makes tax season almost enjoyable with our innovative software, if you have (made/paid) distributions throughout the financial year, you can create and send tax statements to your investors who received a distribution payment.

Try for free

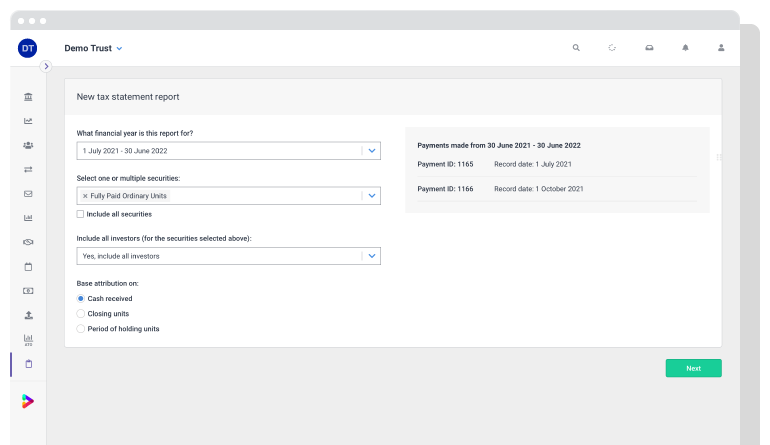

Creating tax statements

To create tax statements, you enter the tax components for your fund in either standard distribution statement (SDS) or AMMA formats.

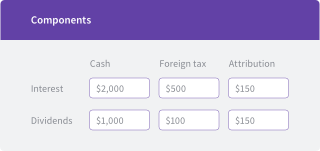

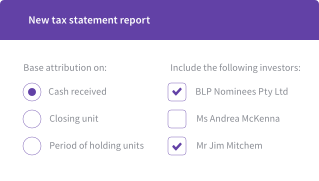

Allocate the components how you define

Our platform can allocate the components to unit holders based on the cash they received, their closing unit holdings or their holding period. Components can even be allocated to specific unit holders.

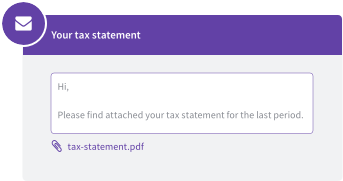

Email statements direct to your investors

Once you have reviewed and approved your statements, email them directly to your investors.

Post statements

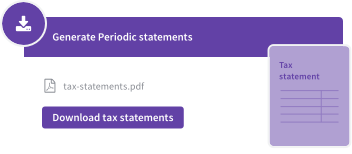

For investors who have elected to receive communication via post, our system produces an easily downloaded pdf file that can be posted.